22.05.2025

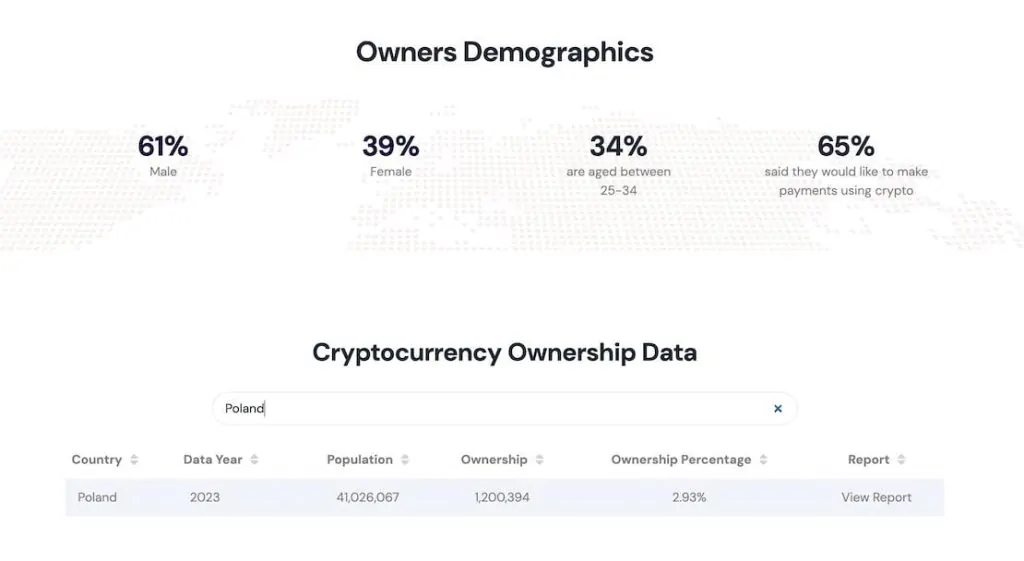

Poland has very flexible laws regarding all crypto activities, including mining, staking, ICOs, airdrops and much more besides. This is partly due to the fact that many Poles own cryptocurrency. According to Triple-A, the number of crypto owners reached 1,200,394 in 2023. This figure is even higher now.

To date, almost 20% of Poles own cryptocurrency, and blockchain innovations are being developed in all economic spheres, including e-commerce, real estate and start-ups.

Thus, Poland is one of the most progressive countries in terms of blockchain innovation. In this article, we will review some of the most common crypto tax rules in Poland and explain how to use them to your advantage.

Is Poland crypto-friendly?

Yes, especially compared to other European countries. Its crypto policy aligns with EU standards. The main focus is on transparency and consumer protection through the Markets in Crypto Assets Regulation (MiCA). Furthermore, the introduction of the PIT-38 form has made it much easier for Polish taxpayers to report their crypto income.

This is one of the main reasons why Poland has become a popular destination for crypto-based start-ups.

Poland’s crypto tax laws are strictly based on the country’s tax laws. As the economy has grown rapidly in all fields, it has become clear that new legislation is needed to regulate cryptocurrencies.

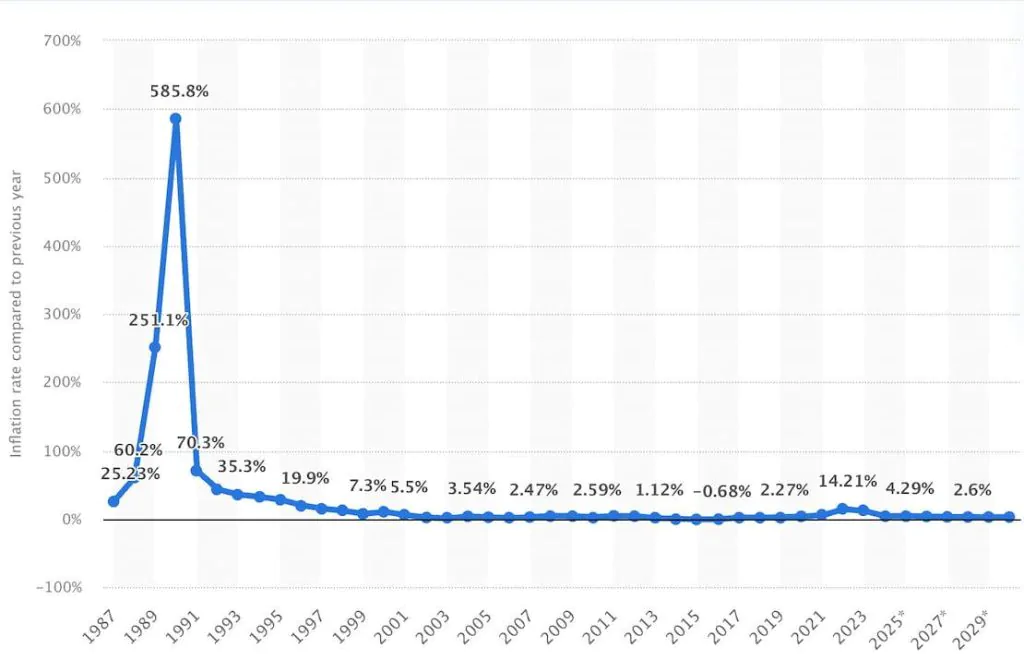

The inflation rate in Poland is falling every year (by 2–3%), and the average annual GDP growth rate is approximately 3–4%. These positive statistics have influenced the rapid growth of the economy. This is why many startups are choosing to move to this European country.

Moreover, Polish society (especially the youth) is becoming interested in cryptocurrency. Bitcoin is the most popular cryptocurrency, holding approximately 56% of the market share, but the volatility of the sector is a concern. Therefore, Poland is open to adopting cryptocurrency in the near future. That’s why it is crucial to understand the necessary legislation for owning and trading crypto in this country.

Are you required to pay crypto taxes in Poland?

Yes, you will pay crypto taxes if you make a profit from converting cryptocurrency into fiat currency. A flat tax of 19% applies to all crypto income.

When you need to pay for crypto activity in Poland. Taxable income

You are obliged to pay such crypto taxes if you convert crypto into fiat, trade different virtual currencies, manage virtual currency accounts, use cryptocurrency to pay for goods or services, or settle debts or obligations with cryptocurrency. However, there are specific rules for each case, which we will review separately.

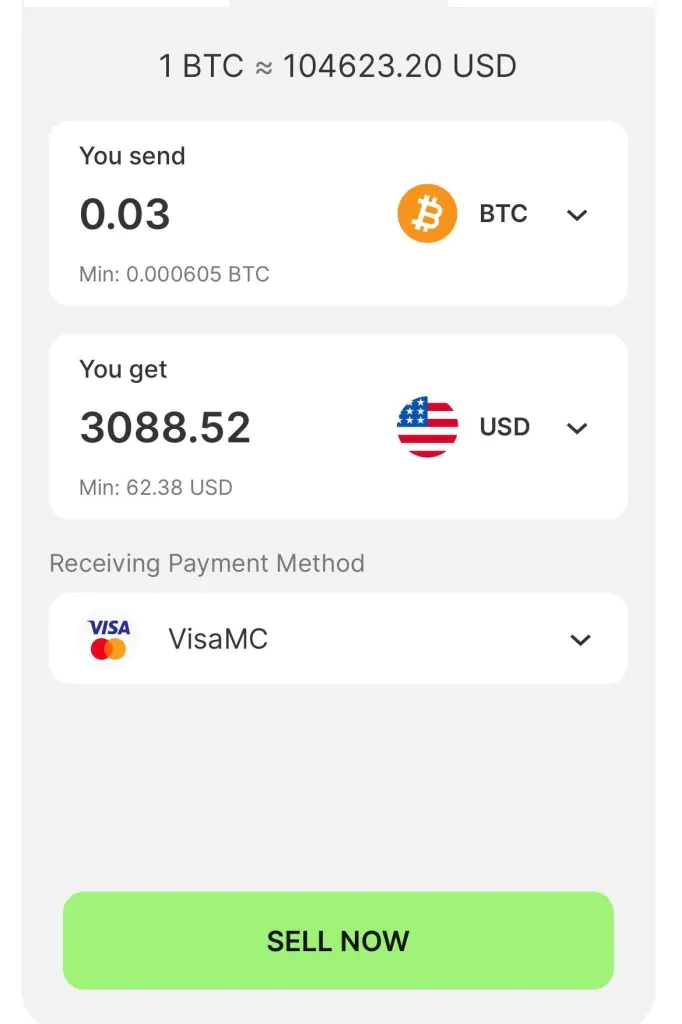

For example, if you want to convert 0.3 BTC to USD in Poland, you can easily do so on Buycoin.online, you may be charged.

You will also be charged if you make a profit from:

- crypto mining and staking, if converted into fiat currency

- crypto margin trades

- futures

- CFDs (Contracts for Difference)

- crypto ICO (Initial Coin Offering)

- selling crypto received through airdrops

- selling crypto received through forks

- selling crypto received through ICOs

When you don’t need to pay for crypto activity in Poland. Tax free transactions

There are also a lot of tax-free crypto transactions in Poland, including:

- buying crypto using fiat currencies

- exchanging crypto for crypto, including stablecoins

- transferring crypto between digital wallets

- receiving different types of crypto rewards via airdrops, ICOs, IDOs, forks, etc.

- simply holding crypto

Thus, if you purchase cryptocurrency with cash on Coin24 in Poland, you won’t be charged.

None of these activities generate additional income. That’s why you can process all these activities for free.

The definition of crypto in Poland

In Poland, crypto is recognised as a digital representation of value. It is not viewed as legal tender. This is why cryptocurrency is treated as property for tax purposes. Therefore, digital assets are subject to capital gains tax. Since 2021, they have been administered by the Register of Virtual Currencies under the Tax Administration Chamber. This means that all crypto start-ups in Poland must obtain a licence to register their business as a Virtual Asset Service Provider (VASP).

For tax purposes, income from trading cryptocurrencies is treated as monetary capital gains. Several actions are recognized as taxable events:

- exchanging cryptocurrency for fiat currency

- using cryptocurrency to pay for goods, services or property

- settling debts with cryptocurrency

- It is important to note that tax liability is not limited to converting cryptocurrency into fiat currency; using it to purchase goods or services also triggers taxation. However, exchanging one cryptocurrency for another or converting cryptocurrency into stablecoins is not considered a taxable event.

Furthermore, as an EU member state, Poland is subject to regulatory frameworks such as DAC-8, which aim to improve compliance and protect investors in the crypto space.

DAC-8 is the eighth amendment to the Directive on Administrative Cooperation in Direct Taxation. It strengthens the legal framework for the automatic exchange of information (AEOI) to combat tax fraud. According to DAC-8, all crypto service providers operating within the EU must collect and share investor data with tax authorities in other EU countries.

How much tax do you pay on crypto in Poland?

Crypto capital gains tax

According to Polish law, all business owners must calculate their income (the difference between the selling price and the purchase price of cryptocurrency) because it is recognized as capital gains. This income is subject to a flat capital gains tax rate of 19%.

How to calculate crypto capital gains and losses

In Poland, it’s quite easy to calculate capital gains and losses. To calculate your income, use the following formula: Aggregate revenue from sales in the year – tax-deductible costs in the year.

In Poland, each purchase generates ‘tax-deductible costs’, aggregated on an annual basis, and each sale generates ‘tax revenues’, also aggregated on an annual basis.

At the end of the year, if tax-deductible costs exceed tax revenues, the loss will be reported and carried forward to the next year.

To calculate this properly, you need to know your cost basis, i.e. how much your cryptocurrency cost you to acquire plus any additional transaction fees.

Then simply subtract this amount from the sale price.

Example of a crypto capital gains tax calculation:

Suppose you bought 100 XRP for 132,051 PLN in January 2025, and later sold 100 XRP for 140,000 PLN.

Disposal amount = 140,000 PLN

Cost basis = 132,000 PLN.

Let’s use the formula:

Capital gains = (140,000 – 132,000) PLN = 8,000 PLN.

At a flat tax rate of 19%, the gain would be 1,520 PLN.

However, remember that you must report all crypto-related costs and sales, regardless of your income. Costs include all purchases of crypto assets and any associated expenses, while sales are recognized as the total revenue generated from selling crypto. Gather this information and report your crypto taxes every year. Report any associated costs even if there is no income this year.

Bear in mind that if your crypto acquisition costs exceed your income from selling it in a given year (or if you have no income at all), you can carry the excess costs forward to future tax years. In those years, these can be treated as part of your tax-deductible expenses, alongside any new crypto acquisition costs.

Only expenses directly tied to the purchase and sale of virtual currencies qualify as tax-deductible. Financing costs (e.g. loans or credit), mining costs (e.g. equipment and electricity) and exchange costs are not deductible.

According to the Polish Ministry of Finance, you should report crypto taxes between 15 February and 30 April following the previous fiscal year.

Lost or stolen crypto

You should consult your accountant or the tax authority to determine how to account for lost or stolen cryptocurrency.

The good news is that you can easily deduct simple crypto losses from your report. To do so, simply state your losses in the current fiscal year on your PIT-8 tax form. These losses will not be counted if you account for them as expenses in the subsequent year.

Other crypto taxes in Poland

Employer tax

As a crypto employer, you are required to participate in the Social Security Contributions system.

The Social Security Institution will apply mandatory payroll taxes each month. These contributions are allocated to various funds, including pensions (9.76%), disability benefits (6.5%), insurance (ranging from 0.67% to 3.33%), and allowances for sick leave or childcare.

Tax on mining crypto

Mining rewards are not taxed at the time of receipt. However, the tokens obtained through mining are assigned a cost basis of 0 PLN. This means that, when you eventually dispose of these assets — for example, by converting them to fiat — the full value is subject to a flat income tax of 19%.

Taxes on staking crypto

Although mining and staking are distinct methods of validating crypto transactions on public blockchains, the Polish tax authorities treat them similarly for tax purposes.

Staking rewards are taxed in the same way as mining rewards.

Crypto taxes on airdrops and forks

Tokens received from airdrops and forks are not taxable. You can convert them to another cryptocurrency immediately. However, if you convert them to fiat, they are given a cost basis of 0 PLN, which triggers taxation. The tax rate applies to the full amount when you dispose of them, as the cost is 0 PLN.

Crypto taxes on gifts and donations

There are no exact laws describing how to handle tax on crypto gifts and donations. However, if we treat them as simple fiat donations, they would be subject to Polish gift and inheritance tax. This tax only applies if the recipient of the asset is a Polish national or permanent resident, or if the donation contract is concluded in Poland.

Crypto taxes on margin trades, futures and CFDs

In Poland, all trades are recognized as simple trades. This is why they are subject to a flat capital gains tax rate of 19%.

ICO crypto taxes

ICOs allow investors to own tokens of the project in exchange for the cryptocurrency (e.g. BTC or ETH) that they invest in the project. Any tokens received from an ICO are not taxable upon receipt. Such tokens have a cost base of 0 NLP. That’s why they are taxed when they’re sold, attracting a flat tax rate of 19%.

NFT crypto taxes

There is no specific NFT legislation in Poland at present. Therefore, any income from selling NFTs will be treated as ordinary income and taxed accordingly. You should always consult your accountant or another relevant professional before selling NFT assets.

DeFi crypto taxes

This is a complete grey area in Polish legislation. Any income generated through staking or lending on DeFi protocols is considered equivalent to income from ICOs, airdrops or hard forks.

DAO crypto taxes

Like ICO income, any tokens received from a DAO are not taxable upon receipt. Such tokens have a cost base of 0 NLP. This means they are taxed when disposed of at a flat rate of 19%.

How to reduce crypto taxes in Poland

Bear in mind that there are no legal ways to avoid crypto taxes in Poland. However, there are ways to reduce costs.

Offset your losses. Made a loss while trading crypto? Simply use them to offset your taxable crypto gains.

Hold your assets instead of trading them. This is the most popular way of minimizing crypto taxes. As we’ve already mentioned, you only have to pay crypto taxes in Poland if you convert your crypto assets into fiat currency.

You won’t have to pay crypto taxes for any of these activities: holding your currency, converting crypto for crypto, buying crypto using fiat currencies, transferring crypto between your digital wallets or receiving different types of crypto rewards via airdrops, ICOs, IDOs or forks.

How to obtain a crypto licence in Poland

There is a list of strict requirements for crypto companies that want to obtain a licence in Poland.

• A clean criminal record

• Hold relevant professional qualification

You will then need to fill in an electronic application and sign a compliance statement for the Minister of Finance. You may then have to wait up to 14 days for the final decision regarding your licence.

If everything is in order, you are free to open your virtual currency company. Submit an e-application to the Minister of Finance containing the following:

• Name, surname or company name

• Tax ID (NIP)

• Trusted personal or e-signature

• The registered entrepreneur number (based on the National Court Register)

An indication that the services are within the field of virtual currencies.

• A statement confirming that all information provided in the application is complete and accurate.

Please note that the registration of your virtual currency company may take up to 14 days.

Conclusion

Poland is one of the most progressive countries in Europe, with a high level of crypto adoption and tax liability. Low inflation, economic diversification, technological proficiency, and widespread cryptocurrency usage in all economic sectors, from retail and e-commerce to education, provide fertile ground for the development of crypto companies here.

This is why crypto taxes in Poland are comparatively low and favourable. However, regulatory uncertainty, security concerns and complex tax laws may hinder the mass adoption of cryptocurrencies in Poland.

However, government initiatives and a vast startup ecosystem in Poland, including DeFi platforms and blockchain-based supply chain management systems, are good signs of positive movement in this sphere.