Cryptocurrencies have become increasingly popular with investors. So it’s no surprise that many people have become interested in investing in digital assets for the long term. To date, the number of crypto users in the UK is expected to reach 23.95 million this year.

13.03.2025

Choosing a reputable, easy-to-use exchange is crucial for both beginners and investors. To date, there are many ways to exchange crypto and conduct all trading operations, and crypto exchanges tend to be one of the most popular.

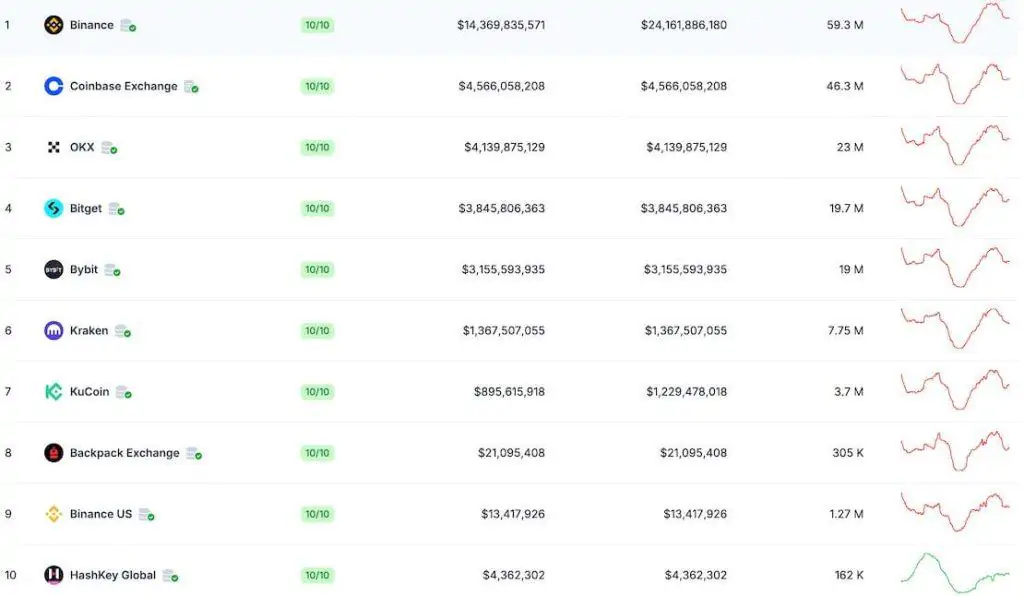

According to CoinGecko statistics, there are 216 crypto trading platforms with a total 24-hour trading volume of $132 billion. The largest are Binance, Coinbase Exchange, OKX, Bitget and ByBit.

If we talk about the leading cryptocurrency exchanges by market capitalization, the list looks slightly different.

However, not all of these platforms are the best choice in the UK due to some legal and trading specifics. So what are the best crypto exchanges in the UK? Let's find out. We've selected the best exchanges according to their interface, fee levels, security and other important criteria.

The Best Crypto Exchanges in the UK February 2025

Bitget

Bitget is one of the most popular global crypto exchanges in the UK, with an extensive list of services including spot trading, futures trading and one-click copy trading (where newcomers can legally copy the positions of experienced traders). The platform also offers highly secure KYC-free trading for privacy-conscious users (check regions where the service is permitted).

Main Features

Supported digital assets: over 800+ coins, including top-listed assets and altcoins, and 900+ trading pairs.

Trading Fees: Competitive trading fees, including spot trades of around 0.1% for both makers and takers by default. Bitget's derivatives markets are even cheaper (e.g. 0.02% maker/0.06% taker for futures).

Security: Bitget has developed a $300 million protection fund, which is a profound guarantee that no hacks or losses will happen on the platform. In addition, Bitget is one of the few crypto exchanges to offer Proof of Reserves, meaning that customer assets are fully backed.

The platform supports two-factor authentication and is legal in UK as it processed the transactions via an FCA-authorized partner to comply with UK financial promotion rules.

ICONOMI

ICONOMI is one of the best crypto exchanges in the UK, offering comfortable trading for both novice and experienced traders.

It also offers a number of useful and profitable services, including copy trading, investing in curated crypto portfolios (a rather cost-effective strategy similar to managing a mutual fund), automatic portfolio rebalancing and recurring buys (which reduces the influence of volatility, making it perfect for newbies).

Main Features

Supported digital assets: 150+ cryptocurrencies (including popular assets such as Cardano, ETH, XRP and altcoins). The platform aggregates prices from multiple exchanges to support competitive pricing and liquidity.

Trading Fees: The ICONOMI crypto trading platform is popular due to its comparatively low trading fees. Buying or selling via a strategy has a fee of around 0.37%, while direct crypto trades are similarly low cost. The platform charges no deposit fees for bank transfers.

Security: ICONOMI is regulated by the UK Financial Conduct Authority (FCA) as a crypto asset business. This makes the platform a perfect choice for UK clients. Client assets are held securely with reputable custodians. It is also regularly audited and supports standard security measures (KYC verification, 2FA, encryption).

Kraken

Kraken is one of the UK's oldest and best crypto exchanges (launched in 2011), supporting a wide range of popular and unique services for traders. Kraken offers spot and margin trading (up to 5x leverage) as well as futures for more experienced traders. Its interface is easy to use, making it a perfect choice for newcomers. Kraken allows UK users to trade in GBP directly on Kraken, so you don't have to waste time with multiple currency conversions. Kraken also supports GBP currency pairs and fiat currency trading.

Main Features

Supported Digital Assets: 200+ cryptocurrencies including BTC, ETH, XRP and many more. This gives you the freedom to create the most diversified portfolio ever.

Trading Fees: Fees start at around 0.4% (taker) / 0.25% (maker) on spot trades for low volume trades. Deposits and withdrawals in GBP via bank transfer are usually free or low cost.

Security: The Kraken UK crypto exchange has invested over $100 million in robust security measures to keep the majority of assets in cold storage (offline) and provide withdrawal whitelisting (to restrict payouts to approved addresses). Kraken is perhaps one of the few exchanges that has never been hacked. In addition, the platform is regularly audited to prove that customer funds are intact. Kraken is FCA-registered in the UK as a cryptoasset firm.

CEX.io

CEX.io is a UK-based crypto exchange with strong customer support, making it a perfect choice for crypto newbies. It offers spot trading, staking, crypto-backed loans, trading fiat currencies for crypto (e.g. convert GBP to USD or EUR on the platform), which can be useful for forex flexibility. CEX.io has a very convenient mobile version for those who don't want to use the desktop version.

Main Features

Supported digital assets: 200+ cryptocurrencies and tokens. CEX.io offers several GBP trading pairs and accepts GBP deposits/withdrawals, making it very convenient for UK traders.

Trading Fees: CEX.io uses a volume-based maker/taker fee model. The taker fee is approximately 0.25% and the maker fee is 0.15% for low volume trades. For high volume traders the fees can be reduced to 0%. You can also get such a discount by providing liquidity. No fees are charged for bank wire deposits. However, credit/debit card transactions will incur a card processing fee of 2%-3%.

Security: The CEX.io cryptocurrency exchange supports standard protections such as 2FA, encryption and cold storage for most funds. As a UK-based company, CEX.io complies with UK and EU regulations (it was one of the first exchanges to implement KYC/AML procedures).

The platform also offers address whitelisting and alerts for suspicious login attempts. If you have a serious problem and need quick help, the platform offers 24/7 customer support. Thus, CEX.io meets all UK crypto regulations and is a great choice for UK investors.

eToro

eToro is a unique platform and one of the best crypto exchanges in the UK, combining traditional brokerage with crypto exchange features. It has an outstanding feature of social trading - any user can follow and copy the trades of experienced investors in real time. It's similar to copy trading, but with more options and traders to choose from. This makes it perfect for beginners who want to learn from the best. eToro's offers trading with crypto, stocks and ETFs in one place Supported digital assets: 100+ cryptocurrencies to trade. In addition, eToro offers access to commodities, currencies and stock CFDs - making it a one-stop shop for various investments.

Main Features

Trading Fees: eToro has zero commissions for stock trading and low cost crypto trades. For regular crypto trades, eToro charges a 1% fee on buy or sell orders.

In addition, eToro has a $5 withdrawal fee and an inactivity fee of $10/month if you don't log in for a year. There are no deposit fees for USD. Overall, eToro's fees are a little higher than other platforms. However, this is offset by the enhanced trading functionality.

Security: The eToro cryptocurrency exchange is a fully regulated brokerage in several jurisdictions. In the UK, eToro (UK) Ltd is authorized by the FCA (FRN 583263), which gives it the right to provide financial services. It is also registered as a cryptoasset firm under UK AML regulations. The platform uses SSL encryption, 2FA for logins and bank-level security measures for fund storage.

Binance

Binance is one of the UK's best crypto exchanges by volume. It has the widest range of services for UK users, including spot trading, futures, options, lending, staking, crypto Visa card and much more. The platform also has a simplified 'Binance Lite' mode for beginners. One of the main advantages of Binance is super-fast trades and transfers. The platform supports instant GBP deposits/withdrawals via Faster Payments (where available).

Main Features

Supported digital assets: over 350+ crypto assets to trade and hundreds of pairs. This literally gives you access to the entire crypto market on one platform.

Trading Fees: Binance offers spot trading fees of 0.1% for both makers and takers (plus you can get discounts if you hold Binance's BNB token or do high-volume trades). This can be as low as 0.075% or less with discounts. Deposit fees are zero for bank transfers.

Security: Binance uses 2FA, address whitelisting, anti-phishing codes and real-time suspicious activity monitoring. Binance keeps the majority of user funds in cold storage and has a financial services compensation scheme. It maintains a Secure Asset Fund for Users (SAFU), which can cover losses in the event of a hack. However, Binance is not directly registered with the Financial Conduct Authority (FCA) in the UK, meaning it operates without local regulatory oversight.

Gemini

Gemini is a US-based cryptocurrency exchange with a famous security-first approach. Gemini has a clean, simple interface for beginners and a more advanced ActiveTrader interface for experienced traders. Gemini's services include spot trading, a built-in wallet with insurance, staking (Gemini Earn) and a crypto rewards credit card (does not work in the UK).

Main Features

Supported digital assets: over 150 cryptocurrencies. UK users can trade in GBP or USD on Gemini and deposit GBP via Faster Payments.

Trading Fees: Gemini's fee structure has two tiers: the basic interface (buy/sell via website or app) charges a convenience fee (~0.5% above market) plus a flat transaction fee (ranging from £0.75 to £2.25 for small trades up to £200, and 1.49% for trades over £200). This can be high for small purchases. However, if you use Gemini ActiveTrader (their advanced trading screen), the fees are much lower - around 0.2% taker / 0.1% maker for low volumes, with discounts for higher volumes.

Security: Gemini is a licensed custodian and FCA-registered in the UK, and was one of the first platforms to complete a SOC 2 Type II security compliance audit. Security measures include: cold storage for most client assets, mandatory 2FA for logins and withdrawals, and strong encryption practices. Gemini also has crime insurance that covers theft from its exchange and custody systems.

Coinbase

Coinbase is one of the best crypto exchanges in the UK. It is perfect for easy buying/selling of crypto using GBP, debit cards or bank transfers. Coinbase actually offers two platforms: the standard Coinbase app (simple interface, great for one-off purchases) and Coinbase Pro (advanced trading), which is aimed at active traders.

Main Features

Supported digital assets: Over 260 cryptocurrencies are listed, including top market cap coins and a large number of altcoins in various categories (DeFi, NFTs, Layer-2 tokens, etc.). UK users can hold balances in GBP on Coinbase and trade many GBP pairs, and integration with UK Faster Payments means that depositing and withdrawing GBP is straightforward.

Trading Fees: Coinbase's fees are slightly higher than some of its competitors, especially on the standard interface. There is a flat fee (£0.99 to £2.99) for small purchases (under £200) and a spread of around 0.5% plus a fee of around 1.49% above that. This can work out to ~0.6%-1.5% per trade for typical users. However, using the Advanced Trade (formerly Coinbase Pro) service reduces the cost significantly - fees start at 0.6% taker / 0.4% maker for the lowest tier and can drop to 0.1% or less for high volumes. There are no fees for depositing GBP via bank transfer, and there is a small fee (around £1) for withdrawals via bank.

Security: The Coinbase cryptocurrency exchange keeps over 98% of customer funds in cold storage, with only a small portion in hot wallets for liquidity. These online funds are insured to protect against exchange hacks. Security features include 2FA, biometric logins for the mobile app, address whitelisting and the option to store your own crypto using Coinbase Wallet (a separate self-custody app). Coinbase is already authorised by the UK's Financial Conduct Authority (FCA) as a registered cryptoasset service provider. This FCA registration (granted in early 2025) confirms Coinbase's legal status in the UK, allowing it to continue to serve UK customers in full compliance.

Tax on Cryptocurrencies in the UK

Cryptocurrency tax implications in the UK

Investing or trading in cryptocurrency has tax implications in the UK

HM Revenue &Customs (HMRC) treats crypto assets similarly to shares or property, meaning that most casual investors will pay Capital Gains Tax (CGT) on profitable disposals, while some crypto activities (such as receiving payments or mining) will incur Income Tax.

Capital gains tax on crypto

If you buy crypto and later sell or exchange it at a profit, that profit will be subject to CGT. Taxable disposal events include exchanging one crypto for another, buying goods/services with crypto, or giving crypto as a gift (except to a spouse). You only pay tax on the gain (increase in value), not on the total proceeds.

Tax-free allowance

For 2024-25, the annual CGT allowance is £3,000 (down from £6,000 in 2023-24). Gains up to this amount are tax-free each year.

CGT rates

Rates depend on your income tax band. Before 30 October 2024, basic rate taxpayers pay 10% on gains above the allowance, while higher rate taxpayers pay 20%. After 30 October 2024, the rates increase to 18% (basic rate) and 24% (higher rate). Investors should apply different rates depending on when disposals occur during the tax year.

Tracking and reporting

Calculate your gain by deducting the cost basis (original cost plus fees) from the sale price. HMRC requires you to use the share pooling method for crypto. You can deduct allowable expenses and offset gains against losses. Gains in excess of the allowance must be declared on a self-assessment tax return. HMRC is actively pursuing crypto transactions, so accurate reporting is essential.

Income tax on crypto

Crypto received through employment, mining, staking or reward is generally subject to income tax.

- Being paid in crypto: Salary or freelance income paid in crypto is considered income at market value when received and will be taxed accordingly, along with any National Insurance.

- Mining: Small-scale mining is miscellaneous income; large-scale mining is business income. Tax is due on the market value of the coins received, less deductible expenses (equipment, electricity).

- Stake/Yield Farming: Rewards are taxed as miscellaneous income at the value when you gain control of them.

- Airdrops/forks: If received for services rendered, airdrops count as income. Unsolicited coins (such as forks) may not be taxable until disposed of, depending on the circumstances.

Income tax rates

Crypto income is added to total taxable income and is taxed at 20% (basic), 40% (higher) or 45% (additional) using standard income tax bands. There's a personal allowance (£12,570) which covers small amounts if there's no other income. Self-employed miners pay Class 2/4 National Insurance.

When is crypto trading a business?

HMRC usually applies CGT to occasional investors. Only frequent, organized, sophisticated trading that resembles a business will be taxed as income. This situation is uncommon and the threshold is high - most individuals will be caught by CGT. If in doubt, consult an advisor.

Crypto Exchanges vs Crypto Wallets

In crypto, wallets and exchanges can be used for different purposes. Therefore, you need to know them well enough to make the crypto user experience comfortable.

Crypto exchanges are a perfect tool for buying, selling or trading cryptocurrencies. Such platforms bring buyers and sellers together; CEXes (such as Coinbase or Binance) act as middlemen. They hold your crypto in an internal account linked to your profile. To use an exchange, you sign up, complete KYC, deposit funds and trade. Crypto exchanges hold your crypto in internal accounts and offer liquidity, convenience and advanced features for traders.

A crypto wallet is another way to send and receive crypto. There are custodial (someone else controls the keys) and non-custodial (you control your own keys, like MetaMask, Trust Wallet, Ledger or Trezor). Non-custodial wallets give you full control and responsibility for security.

Crypto exchanges store large amounts of user funds, making them popular targets for hackers. Wallets are less vulnerable to hacking. However, you are solely responsible for key storage.

For beginners, storing crypto on crypto exchanges may be easier at first. However, wallets are strongly recommended for long-term storage or decentralized applications. Many users buy assets on crypto exchanges and then transfer coins to their wallets for more secure storage. Hardware wallets (such as Ledger and Trezor) offer maximum security.

Use crypto exchanges for frequent trading or quick market access, but use wallets if you want secure, long-term storage.

Which crypto trading app is legal in the UK?

The UK's Financial Conduct Authority (FCA) regulates cryptoasset companies for anti-money laundering (AML) purposes. From January 2020, crypto exchanges serving UK customers will be required to register with the FCA under the AML regime and comply with disclosure and anti-money laundering rules.

Legally available applications in the UK include

Coinbase - registered (February 2025), fully compliant, Binance, Kraken, Kriptomat, Kripto, eToro, Crypto.com, Bitstamp, CoinJar, Coinpass, Gemini, Ziglu, Revolut and PayPal are among those registered or authorized by the FCA.

Registered exchanges are subject to FCA scrutiny of AML compliance and marketing practices. From 2020, all exchanges and crypto apps for UK customers will have to comply with money laundering regulations, as well as strict disclosure and AML rules.

Using FCA-registered exchanges guarantees legal protection for investors. Unregistered platforms shouldn't offer crypto services in the UK. This will leave users with less legal protection if problems arise.

Always check for FCA registration before registering with an exchange.

Is Coinbase legal in the UK?

Coinbase is fully legal and operational in the UK. The platform achieved FCA registration in February 2025, confirming that Coinbase now meets all UK regulatory requirements for crypto businesses. Prior to this, Coinbase had long operated in the UK under an e-money licence for fiat services and under temporary permissions for crypto while the registration process was underway.

With the FCA's approval now formalized, Coinbase has the green light to continue serving UK customers and even expand its services. The FCA registration allows Coinbase to offer both crypto and fiat services in the UK as a compliant business.