Cryptocurrency is subject to taxation in Italy. However, the Italian tax authority has recently changed its cryptocurrency tax laws, making the period from 2023 to 2025 a transformative one for crypto and NFT taxation. It is therefore crucial to understand how Italy taxes crypto-assets (including Bitcoin, altcoins, and NFTs) and the impact of the new rules on capital gains, staking income, DeFi yields, and more.

01.07.2025

Spain is one of the top 10 countries globally in terms of crypto adoption, having shown strong year-on-year growth.

According to Coinmap, there are currently around 51 Bitcoin ATMs, 12 blockchain companies and almost 120 merchants and businesses that accept Bitcoin as payment. Currently, there are over 14 million crypto users in Spain.

Last year’s report, shared with Bitcoinist, revealed that around 60.7% of Spanish residents plan to purchase and hold cryptocurrency long term.

These facts all prove that crypto is set to become a mainstream financial instrument in Spain and crypto taxes regulation here becomes necessary.

This explains why the legislative framework for cryptocurrency is developing so quickly here.

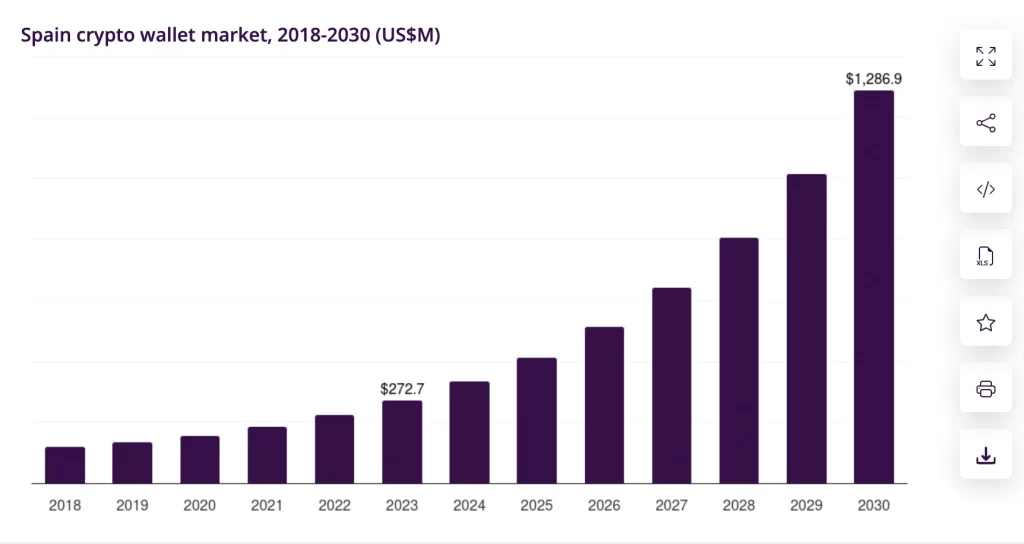

According to Horizon Research, the Spanish crypto wallet market generated revenue of USD 272.7 million in 2023 and is expected to reach USD 1,286.8 million by 2030.

In this article, we will review the main trends and tendencies in Spanish cryptocurrency taxation and explain how to minimize your tax liability.

Is Spain crypto-friendly?

It is a crypto-friendly country with a developing legal framework that allows crypto holders to minimize their tax liabilities. The country actively regulates crypto exchanges and enforces anti-money laundering (AML) compliance.

Furthermore, Spain has introduced Royal Decree 7/2021, which defines and regulates crypto-to-fiat exchanges and custodian services in accordance with anti-money laundering regulations.

This follows the EU’s MiCA regulation, which has been in full effect since December 2024 and enables standardized licensing and operations across EU member states.

Are you required to pay crypto taxes in Spain?

Yes, you are required to pay crypto taxes in Spain. The Spanish State Agency for Tax Administration (Agencia Tributaria) considers gains from crypto transactions and other crypto assets, as well as any income generated from your crypto holdings or activities, to be taxable.

Receiving crypto as an inheritance or donation is also a taxable event and falls under inheritance and donation tax.

Additionally, a wealth tax is implemented in most regions of Spain if the total value of your crypto assets exceeds a certain threshold.

How much tax do you pay on cryptocurrency in Spain?

There are major rules that apply to crypto income in Spain.

Most transactions fall under the Income Savings Tax (Capital Gains Tax), ranging from 19% to 28%.

General income tax also depends on the amount of income and varies from 19% to 47%.

The Wealth Tax (0.21%–3.75%) applies to a total value exceeding €700,000. This amount may vary depending on the region of Spain.

Inheritance and Donation Tax varies from 7.65% to 34%.

Spanish taxpayers must declare cryptocurrency holdings exceeding €50,000 held outside Spain.

Crypto taxes in Spain: Income Savings Tax (Capital Gains Tax)

Income Savings Tax (Capital Gains Tax) applies to capital gains and losses generated from cryptocurrencies. This means that you pay tax on the profits you make from selling, trading, gifting or otherwise disposing of an asset in exchange for fiat currency (such as EUR or USD).

There are several progressive tax brackets for Capital Gains Tax in Spain. This means that the rate changes in accordance with the total value of your income.

This is how it is calculated:

- 19% for the first €6,000 of taxable income.

- 21% for the next 6,001 to 50,000 euros of taxable income.

- 23% for the next 50,001 to 200,000 euros of taxable income.

- 27% for the next 200,001 to 300,000 of taxable income.

- 28% is applied to any amounts over €300,000.

Crypto taxes in Spain: Gains and losses from the transfer of assets

According to Article 33.1 of the Personal Income Tax Law, any change in a taxpayer’s net wealth is considered a capital gain. This includes profits from the sale or exchange of digital assets. Furthermore, both crypto-to-crypto and crypto-to-fiat transactions fall under this category.

Article 34 of the IRPF Law states that the difference between the sale proceeds and the acquisition cost is taxable.

When exchanging assets, the value of the asset with the highest value at the time of the swap is taken into account.

Here’s an example of how this is calculated:

Suppose you bought 10 ETH on 15 April 2021 for €2,000, totalling €20,000. Then, on 15 May 2025, you sold 10 ETH at a rate of €3,000. The total value is €30,000.

Gain calculated: €30,000 – €20,000 = €10,000.

Tax:

The first €6,000 will be taxed at 19% → €1,140.

The remaining €4,000 will be taxed at 21%, equating to €840.

Total CGT = €1,980.

Note that if you were a non-EU/EEA resident, the gain would be taxed at a flat rate of 19%.

Crypto taxes in Spain: General income tax

If you receive cryptocurrency in exchange for goods or services, or through mining or any other activity that results in you acquiring new coins or tokens, this is considered general taxable income and is subject to general income tax.

Income mined, staked or received via an airdrop is recognized at the fair market value of your coins at the time of receipt.

Spanish general income tax is also levied according to progressive tax brackets.

- 19% for the first €12,450

- 24% on the next 12,450 to 20,200 euros

- 30% for the next 20,200 to 35,200 euros

- 37% for the next 35,200 to 60,000 euros

- 45% for the next 60,000 to 300,000 euros

- 47% for any amounts over €300,000.

Crypto taxes in Spain: Wealth Tax

In Spain, all substantial assets (fiat or cryptocurrency) are subject to wealth tax. Depending on the region, the rate can range from 0.2% to 3.75%.

Madrid is the only region where this tax is not imposed; however, if your total asset value exceeds 2,000,000 euros, you must still submit a Wealth Tax Return for information purposes.

In other regions, the threshold starts at 700,000 euros and the tax rate varies from 0.21% to 3.75%.

- In Catalonia, the wealth tax rate ranges from 0.21% to 2.75%.

- In Asturias, the wealth tax rate ranges from 0.22% to 3%.

- The Region of Murcia: the wealth tax is between 0.25% and 3.5% .

- In Andalusia, the wealth tax rate ranges from 0.20% to 2.5%.

- In Cantabria, the wealth tax threshold is between 0.24% and 3.03%.

- The Community of Valencia: the wealth tax is between 0.25% and 3.5%.

- Balearic Islands: the wealth tax is between 0.28% and 3.45% .

- Extremadura: the wealth tax is between 0.3% to 3.75%.

Crypto taxes in Spain: Inheritance and Donation Tax

This tax applies to all digital assets that you receive as an inheritance, gift or donation. The inheritance and donation tax rate ranges from 7.65% to 34%. As with wealth tax, inheritance and donation tax rates may vary in each autonomous community.

Tax rates and reductions vary based on:

- The relationship to the deceased/donor

- the amount received

- Your region of residence (since autonomous communities apply significant reductions).

Let’s look at an example.

Suppose you are a Spanish resident.

Your non-resident uncle gifts you 1 BTC, valued at €60,000 at the time. According to the level of your family connection, he’s in Group III.

The tax base is €60,000, which is subject to a tax rate of between 15.3% and 21.25%, plus a multiplier depending on the region and wealth.

The final tax would be €10,000–€15,000 unless you live in a region (e.g. Madrid or Andalusia) that offers a discount of up to 99% for close relatives.

Tax-free crypto transactions

If you buy, hold or transfer cryptocurrency between your own wallets, this will be tax-free. However, you may still pay taxes if the total value is too high, in which case you will become subject to wealth tax.

In general, this type of crypto transaction is tax-free.

- Buying cryptocurrency

- Holding cryptocurrency (unless you exceed the wealth tax threshold).

- Moving cryptocurrency between wallets

- Token swaps

- Inflow from hard forks

Do you have to declare your crypto transactions in Spain?

Yes, it is necessary to declare all income you get from cryptocurrencies or other crypto assets, including gifts, in Spain.

However, Article 96 of the Spanish Personal Income Tax Law states that you don’t have to declare crypto transactions below 1,000€ as part of your general income.

What is the deadline for declaring crypto taxes in Spain?

The Spanish tax year coincides with the calendar year. However, you must submit your income tax returns by 30 June of the following year.

Conclusion

Spain stands out as a crypto-forward country with clear regulations and growing adoption, but it pairs this openness with strict tax obligations. Whether you are trading, holding, mining or inheriting cryptocurrency, the Spanish tax system requires full transparency and timely reporting. Progressive rates and detailed rules mean that staying compliant is key, but for those who do, Spain remains one of the most structured and navigable crypto environments in Europe.