As of July 2025, over 37 million unique cryptocurrencies had been created. This suggests that the cryptocurrency market is overheated.

28.02.2025

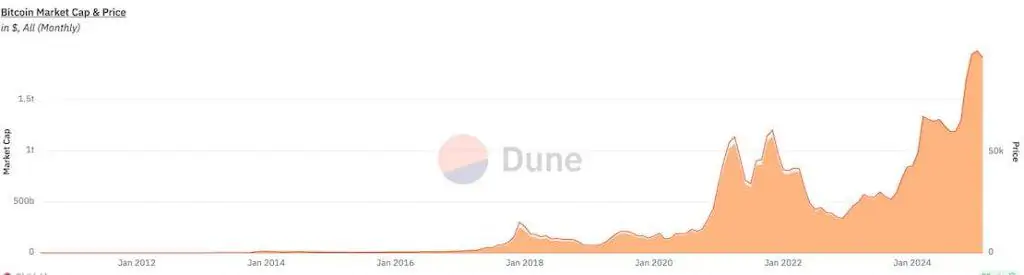

In 2025, bitcoin remains the world’s number one cryptocurrency and is not losing ground. To date, the market capitalization of bitcoin is $1,752.2 billion. It has grown steadily with the price.

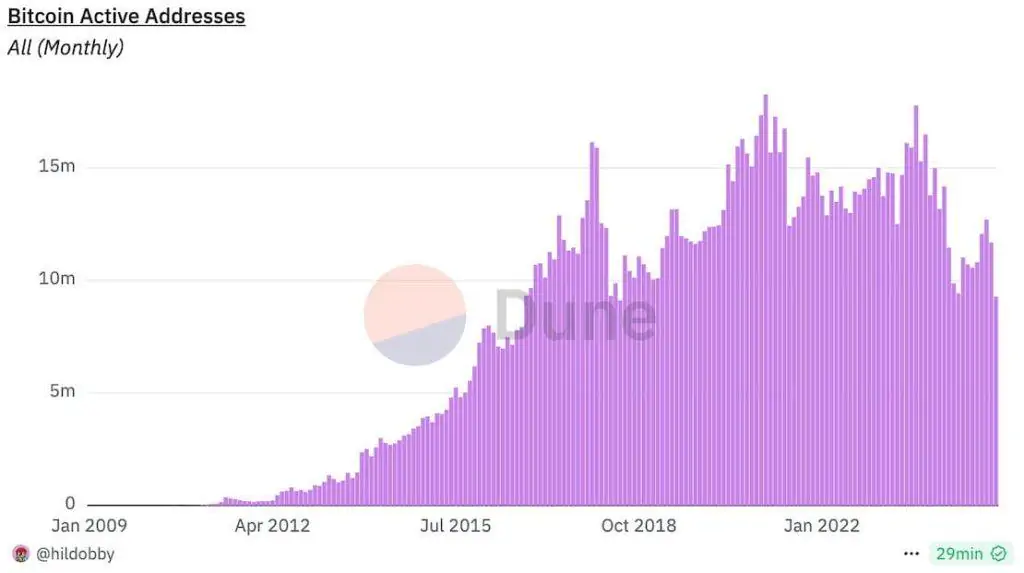

The number of active bitcoin addresses is over 9 million and remains relatively stable.

A bill to create a bitcoin reserve in the US state of Oklahoma, HB 1203, has been approved by the State Oversight Committee and is awaiting a vote in the House of Representatives.

However, there’s some negative news affecting the price of bitcoin, which led to its fall on 26th February when the digital gold reached the $85,000 mark.

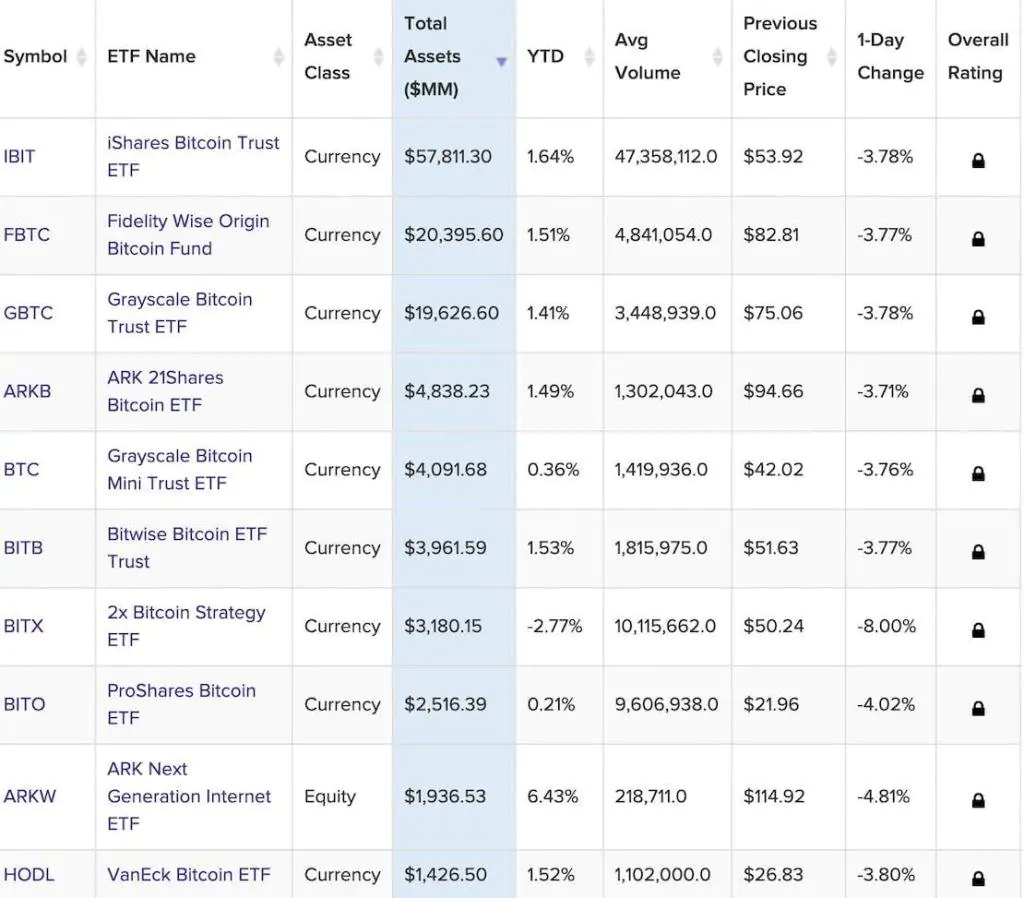

First, between 17 February and 21 February 2025, there were net outflows of $559.41 million from spot bitcoin ETFs and inflows of $1.61 million into Ethereum ETFs, according to SoSoValue.

Some experts say that from a technical point of view, bitcoin could roll back to the next support level of $73,000. However, this is the next support level and bitcoin won’t go any lower.

Arthur Hayes, co-founder of the BitMEX exchange, also predicted a fall to $70,000 due to ETF outflows. But all the experts agree that it’s just the big fall before the big rise.

So whatever happens to bitcoin, it will undoubtedly come back.

What is Bitcoin?

Bitcoin is a cryptocurrency created as a form of payment that can’t be controlled by any person or group of people, government, company, etc.

Bitcoin was created as an open source digital payment system. The main feature and benefit of this project is that it has become the basis of a reliable and decentralized system for transfers.

The nature of digital gold

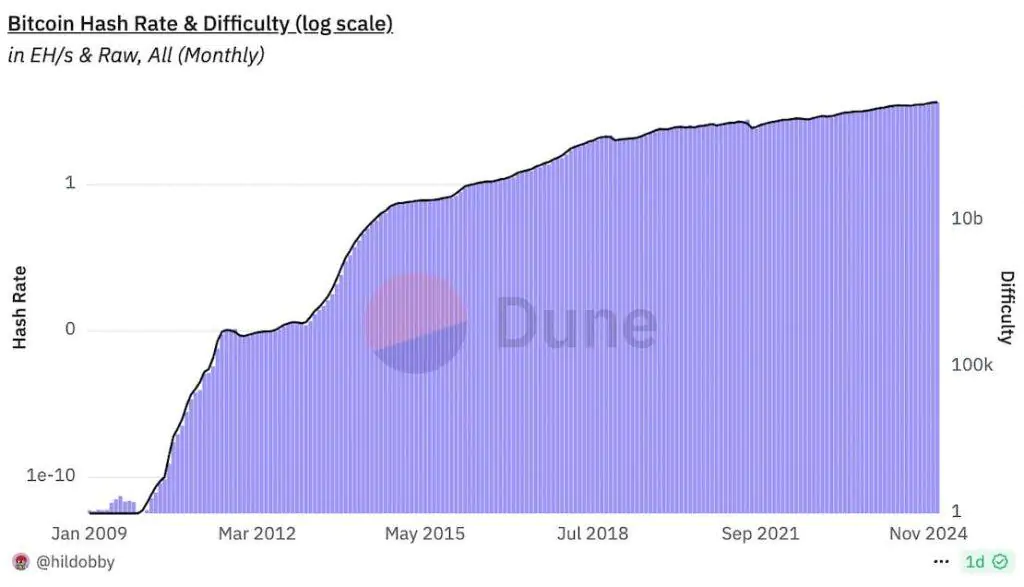

The first cryptocurrency is based on the PoW algorithm, which adds a new block to the blockchain, validates transactions and verifies a single version of the registry across all copies of the registry stored by individual nodes.

In PoW, miners solve complex cryptographic puzzles to add a new block to the blockchain. The first to do so receives a reward for the block, as well as transaction fees.

The bitcoin blockchain is a digital ledger that stores all transactions ever made, grouped into ‘blocks’, and each block is linked to the previous block, forming an unbroken ‘chain’ of blocks. Because the blockchain is transparent, anyone can view the entire transaction history.

How do beginners buy bitcoin?

Buying bitcoin for beginners isn’t much different from buying bitcoin for experienced users. There are several popular methods of buying bitcoin these days.

After a series of records, bitcoin hit several consecutive ATHs in 2024. On the morning of 22 November, it reached an all-time high of $99,300.

The latest and biggest all-time high for bitcoin is $108,786.00 and was reached on 20 January 2025.

However, despite the fact that bitcoin is very popular, it can be risky and even dangerous to buy bitcoin without researching the subject and learning all the important safe ways to do so.

Here’s a list of the main ways to buy bitcoin in 2025:

- Centralized exchanges

- Decentralized exchanges (for wrapped bitcoin)

- Bitcoin ATMs

- Bitcon ETFs

- P2P platforms

- OnRamp services

Let’s take a closer look at each of these.

Centralized exchanges

Centralized cryptocurrency exchanges tend to be very convenient for crypto trading and have a user-friendly interface. There are a number of options available on each of them, offering different ways to facilitate cryptocurrency buying, selling and trading (e.g. margin trading, lending and more).

To buy bitcoin on centralized cryptocurrency exchanges, users have to register online and go through the KYC process. The main advantages of CEXes are high liquidity, a wide range of trading pairs, financial assets, seamless transactions and 24/7 support.

However, you should take into account that each CEX is controlled by a centralized organization, so here we deal with centralized asset storage. These companies act as intermediaries between buyers and sellers. That’s why you should be aware of possible hacks and regulatory restrictions.

The best known CEXes today are: Binance, WhiteBit, Bybit, Kucoin, Gate.io, OKX. However, there are many platforms to choose from. Find out more about their fees and policies first, and then make your final choice.

How to buy bitcoin on CEX

- Register for an account

- Confirm your account by email

- Go through KYC and verify your identity

- Fund your account

There are several ways to buy bitcoin at any CEX:

Credit/Debit Card. To buy bitcoin with a credit/debit card, click on the “Buy Cryptocurrency” button in the top bar, select bitcoin and then click on “Credit/Debit Card”. Select the amount in fiat and click “Continue”.

Add your bank account card as a payment method (you will need to fill in the forms with the card number, CVV, expiry date and the owner’s address).

Pay for your purchase using the card you added. Some banks also require confirmation in their app.

Stablecoins. First, you can convert one of your stablecoins (e.g. USDT) into bitcoin. To do this, select the appropriate option from the CEX menu, enter the correct amount of USDT and press ‘Convert’. Approve the transaction. Secondly, you can choose to trade spot. Simply select the USDT/BTC trading pair, enter the correct amount of bitcoins and approve the transaction. Either way works perfectly well, but spot trading gives you more options, such as choosing the exact rate at which you want to buy bitcoin.

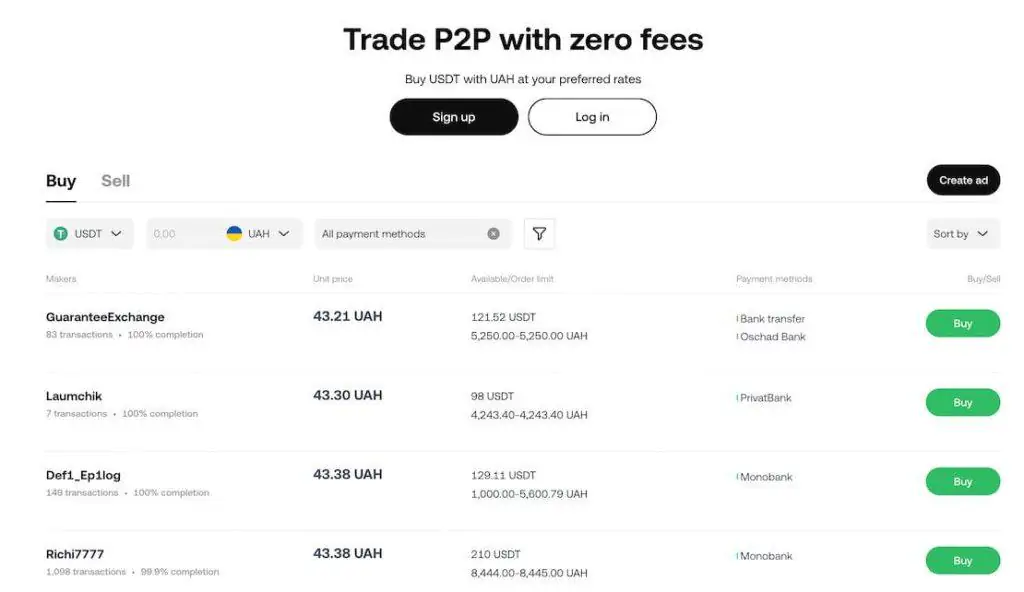

P2P. To get the best P2P option, set the payment method, amount and currency, select bitcoin and filter the offers. Choose the most relevant offer from the list of available offers (look at the merchant’s reputation, supported payment methods, price and available volume).

Before choosing any of these methods, you should find out more about their fees, security measures and other features.

Decentralized Exchanges (DEXes)

Decentralized exchanges are peer-to-peer platforms where crypto trading happens directly between traders. There’s no need to use intermediaries. Decentralized cryptocurrency exchanges represent a free trade zone in the cryptosphere.

The main advantages of DExes are the elimination of the need for central authority, the use of smart contracts that enhance all trading processes and the elimination of the need for KYC. As DEXes are not controlled by centralized resources, you can be sure that no one can block your funds or keep your private keys. The most popular DEXes today are Uniswap, Jupiter, dYdX, PancakeSwap, Curve DAO, Jupiter.

DEXes are more user friendly and can be a good choice for newcomers to the field. All you have to do to use the exchange is connect a crypto wallet and then connect it to the exchange using the address.

DEXes are usually divided into two groups: those who use AMMs and those who use order books. Order books are usually used by the first generation of DEXs. This is where traders create bid and ask orders.

AMMs eliminate order books by using liquidity pools where the crypto exchange rate is automatically determined. This is where user funds play a crucial role.

To date, DEXes are built on many major blockchains, including Ethereum, Avalanche, Arbitrum and Polygon.

How to buy WBTC on DEX

As mentioned above, you can’t buy bitcoin on DEX – only its wrapped version. Wrapped bitcoin (BTC) is bitcoin that has been converted for use on the Ethereum blockchain. Wrapped bitcoin is pegged to the real bitcoin price, so you can trade it for profit, and each WBTC is always backed by bitcoin.

To buy WBTC on any DEX, you’ll need to download the crypto wallet (e.g. Metamask). Enter the name of the token or its address in the search window: to find the contract address of a token, visit the explorer corresponding to the network of the token: for WBTC on Ethereum, it will be Etherscan. Import the token into your wallet list and press ‘Buy’. Enter the amount of WBTC you’d like to buy and choose your payment method.

Wallets such as MetaMask offer numerous methods to purchase crypto, including debit/credit cards, Google Pay, Apple Pay, bank transfers (e.g. you can use ACH transfer in the US and SEPA in Europe) and others.

Select a purchase offer and authorize the transaction. Look at all the fees involved in the transaction. Choose the best option.

You can also choose the ‘swap’ option in your crypto wallet to exchange one token for another. However, beware of slippage, which occurs when the exchange rate changes between the time you place your order and when it is confirmed.

Bitcoin ATMs

Bitcoin ATMs work just like regular cash machines, except you can use them to buy and sell bitcoin. To buy bitcoin from a Bitcoin ATM, you must first scan a QR code on your device using a mobile crypto wallet and then deposit cash. Once the transaction is confirmed, the cryptocurrency is automatically credited to the wallet address from which the scan was made.

How to buy bitcoin at an ATM

Before you make a transaction, make sure you understand all the fees involved and where to send the bitcoin you just bought.

Selling bitcoin at ATMs is just as easy – simply send the required amount of the digital asset to a special wallet. You’ll then receive a special QR code. Scan it at the ATM to get cash.

Keep in mind that each ATM has specific limits. And these limits can vary depending on the type of ATM and the country it is in. You will usually need to be verified for larger transactions. However, if your transaction is under the limit, you can keep it 100% confidential, making ATMs perfect for everyday small and medium transactions. In addition, CCTV footage is deleted 24 hours after the customer interaction.

Bitcoin ETFs

In early 2024, the Securities and Exchange Commission approved bitcoin ETFs, which are now traded on major exchanges. If you find it difficult to buy bitcoin or any other digital asset through DEXes, CEXes or other crypto methods, ETFs may be your perfect choice.

Bitcoin ETFs are exchange-traded funds that track the value of bitcoin and can be purchased on traditional exchanges. This method can be very convenient for all traditional investors who prefer to use classical financial system and stocks instead of investigating new cryptocurrency sphere to buy bitcoin.

Where to buy bitcoin ETFs: investment advice

To date, many online brokers offer bitcoin ETFs. As of early 2024, the SEC has approved 11 bitcoin ETF applications, including from BlackRock, Ark Investments/21Shares, Fidelity, Invesco and VanEck.

All can be found on Charles SchwabFidelity, E*Trade, Robinhood and Interactive Brokers.

To buy bitcoin or other financial assets, you’ll need to open a brokerage account if you don’t already have one. Then go to the platform and search for the ETF you want. Compare a few ETFs to choose the best option. Double check all the trade details to make sure you are getting the right number of bitcoin ETF shares for the right amount of money. Place your trade. If your order goes through, you will own a bitcoin ETF.

P2P platforms

P2P is when you purchase bitcoin directly from another user, without going through an intermediary in the form of an exchange or an exchanger. P2P involves direct approval of the transaction with no automation. Many P2Ps also have a very convenient option for express purchases through quick exchange forms.

How to purchase bitcoin on P2P platforms

Buying bitcoin on P2P platforms is similar to buying bitcoin through P2P services on CEXes.

First, create an account on a P2P exchange such as LocalBitcoins, Paxful or Venmo. Check out all the sellers and options available. Many of them offer to buy bitcoin with cash, wire transfers, prepaid cards, etc.

For the best P2P experience, choose your payment method, amount and currency, then filter the offers. Choose the most suitable option from the available listings – consider the merchant’s reputation, supported payment methods, price and available volume. Once you have negotiated the final price, terms and other payment details, send the payment or meet the seller in person to ensure you are happy with all the details of the deal.

OnRamp Services

How to buy bitcoin on OnRamp platforms

OnRamp services are a bit like a cross between an exchanger and a cryptocurrency exchange. They allow you to purchase bitcoin or any other digital currency directly through your bank card and are often available as an add-on for cryptocurrency wallets or decentralized exchanges (DEX). The most popular OnRamp services are MoonPay and Transak.

OnRamp is very convenient as it allows you to pay for bitcoin using Google Pay, Apple Pay or a banking app. However, they usually require a KYC process.

How much does 1 Bitcoin cost to buy?

You can always go to the Buycoin.online swap widget to see the current bitcoin rates.

In October 2010, the price of bitcoin was less than $0.10. BTC began to rise above $1, reaching a high of $29.60 on 8 June 2011. In November 2012, bitcoin surpassed $1,000 for the first time. In May 2017, the price of bitcoin skyrocketed to close at $19,188 on 16 December.

After that, bitcoin had a lot of ups and downs, growing steadily. On 7 November 2024, bitcoin hit another ATH of $76,999 following the re-election of Donald Trump as president. On January 2025, BTC reached its highest ATH of $109,993.

Is it worth buying $100 bitcoin?

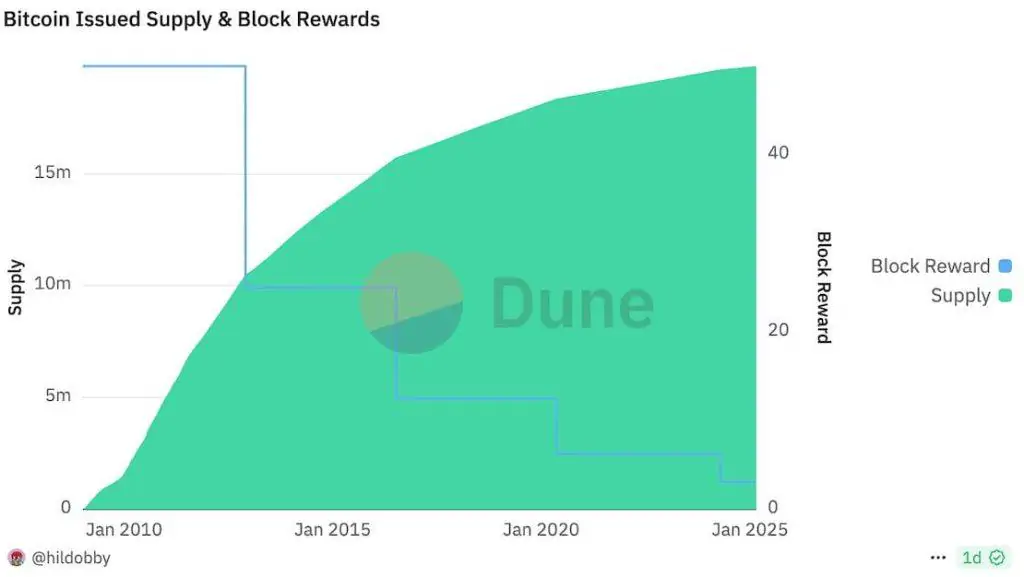

It’s always worth buying bitcoin, no matter how much money you have. As a unique cryptocurrency and digital gold, bitcoin is always in demand and becomes more financially attractive with new halving every 4 years.

So the question is not whether to buy or not, but how regularly you can invest in bitcoin. But remember, all crypto investments are risky and only you are responsible for the consequences.

Conclusion

No matter how you want to use bitcoin: as an investment or a medium of exchange. The most important thing is to choose the best buy/sell option. Some platforms are perfect for buying quickly and holding for the long term (like CEXes). Some are better if you like to trade (like ATM). Put your goals first before buying bitcoin and you’ll always win.