Portugal has earned a reputation as one of Europe’s most crypto-friendly countries. According to Statista, the crypto revenue in this country is going to reach $294.2 mln in 2025 and the average number of users is expected to reach 3.40m users by 2026.

11.02.2025

Despite the ongoing Bitcoin rally in 2024-2025, many experts are still afraid to invest in it due to its volatility and numerous pumps and dumps in the past. Crypto enthusiasts are well aware that Bitcoin’s price always reflects market sentiment and investors’ enthusiasm for BTC in particular. It has fluctuated over the past 10 years and has been low during crypto winters and other political and economic events that have also affected the traditional financial market. However, it has always returned on a boomerang-shaped upward trajectory.

There’s still no other asset as popular as Bitcoin because of its unique nature. At the end of 2024, diigital gold reached a few new ATHs.

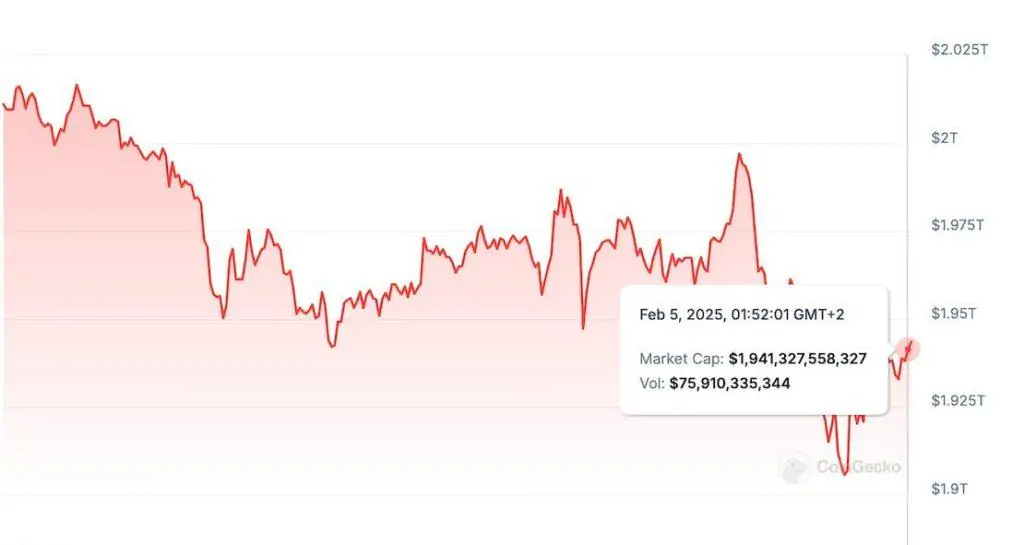

On the night of 4 February, the price of the first cryptocurrency recovered to $100,000. The catalyst was reports that Washington had suspended for 30 days the imposition of 25% tariffs on goods from Mexico and Canada, following talks between the countries’ leaders and the US President.

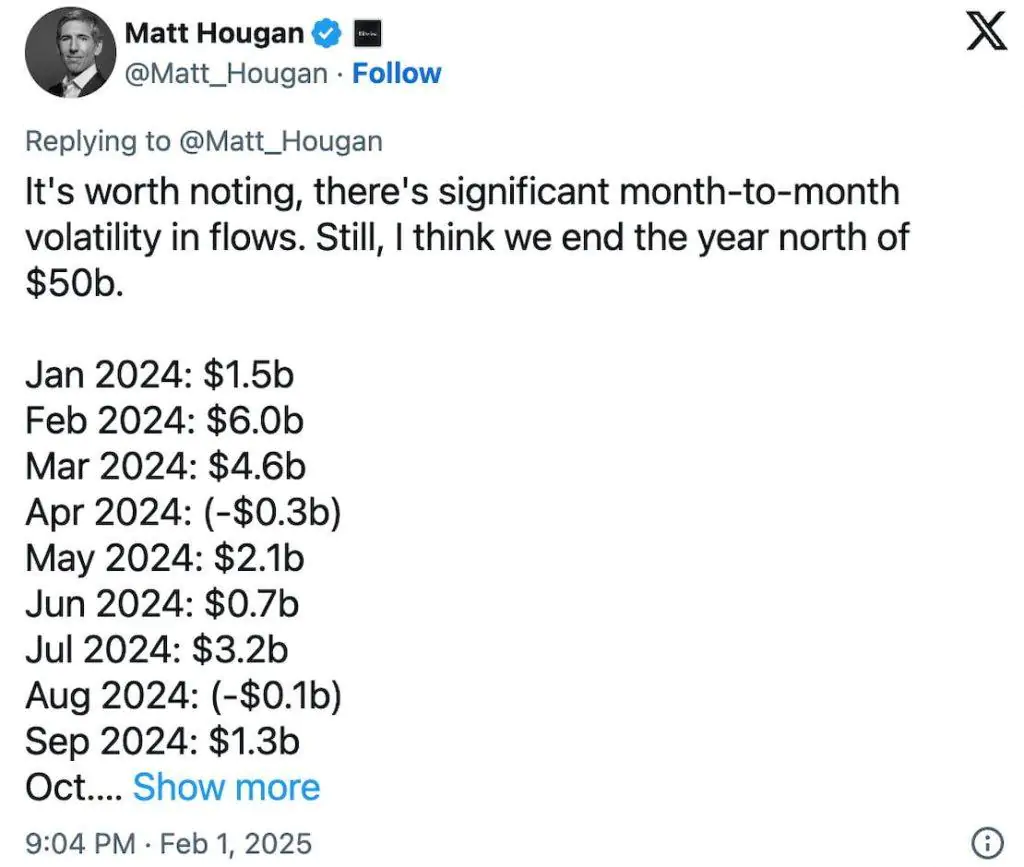

Matt Hougan, CIO of Bitwise, estimated inflows into spot Bitcoin ETFs in 2025. He believes they will reach $50 billion.

And earlier this month, the US Securities and Exchange Commission (SEC) registered Bitwise’s combined Digital Gold and Ethereum-based Spot Exchange Traded Fund (ETF) on an “expedited basis”.

These are just a few positive factors at the start of the year to say that BTC is definitely going to be OK.

No matter what happened in the market, the price of Bitcoin continued to rise.

However, despite the fact that investors have a lot of faith in the first cryptocurrency, many of them still advise to hold only a small amount of your portfolio in BTC, usually between 1% and 2%.

Many experts are predicting another Bitcoin epic run in 2025, so it’s better to prepare for the year by learning the best ways to invest in it in 2025, including direct investments, spot ETFs, investing in mining stocks and more.

Every few years, BTC crashes and bounces back. News of the creation of the US Bitcoin Strategic Reserve and full government support are big green flags signalling that digital gold is here to stay.

In this article, we’ll look at all the possibilities for your successful Bitcoin investment.

What is Bitcoin?

Bitcoin is a virtual digital currency that functions as a form of money and payment. It is not controlled by any person, government, financial group or corporation. It uses peer-to-peer transactions based on a platform that records and secures all transactions. It is protected by encryption and validated by peers. The blockchain technology is transparent, meaning that anyone can see the list of all transactions within the system. Digital gold is fully decentralised and doesn’t require the involvement of a trusted third party.

In August 2008, Satoshi Nakamoto registered the domain Bitcoin.org. In October 2008, he announced the appearance of digital gold on metzdowd.com:

“I’ve been working on a new electronic money system that’s completely peer-to-peer, with no trusted third party.” The now famous white paper published on Bitcoin.org entitled “Bitcoin: A Peer-to-Peer Electronic Cash System”.

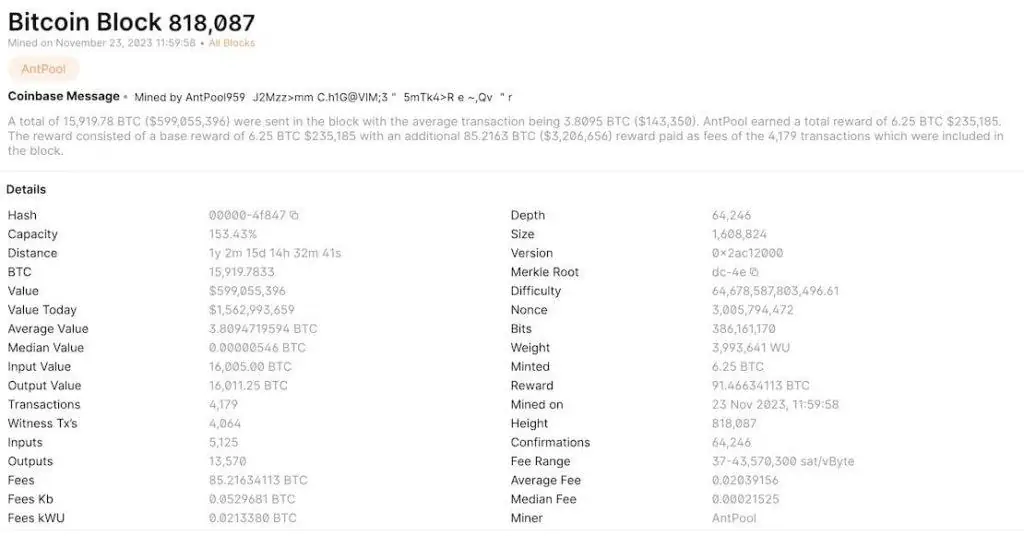

The first BTC block was mined in January 2009. Mining is the key process within the ecosystem: it is the process of validating transactions, which requires miners who are rewarded in Bitcoin. Bitcoin users pay fees to miners to process their transactions. Every 210,000 blocks there is a halving, which means the Bitcoin reward for mining is halved. For example, the reward was cut to 25 BTC in 2012, 12.5 in 2016 and 6.25 in 2020. On 19 April 2024, the halving of rewards dropped to 3.125. This process is useful because it reduces potential inflation by reducing the amount of new supply available.

Is Bitcoin really worth investing in?

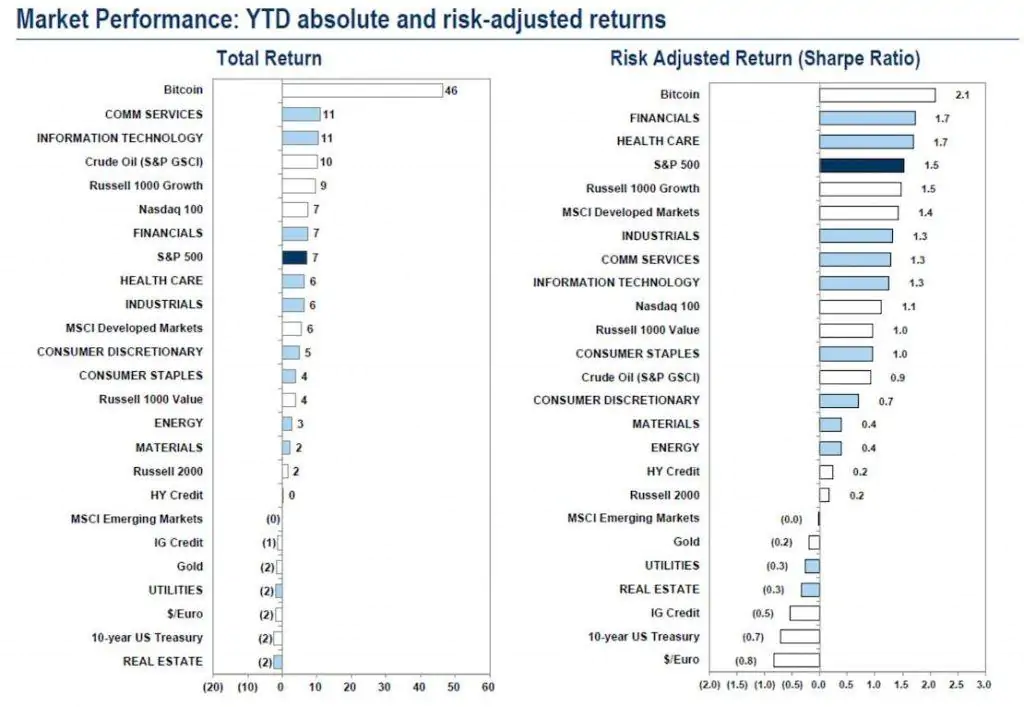

Short answer: yes. Now let’s get into the details. According to Goldman Sachs, Bitcoin has had better risk-adjusted returns YTD than all other currencies, commodities and stock indices. That means you are likely to get a better return than investing in any of the other things in this picture.

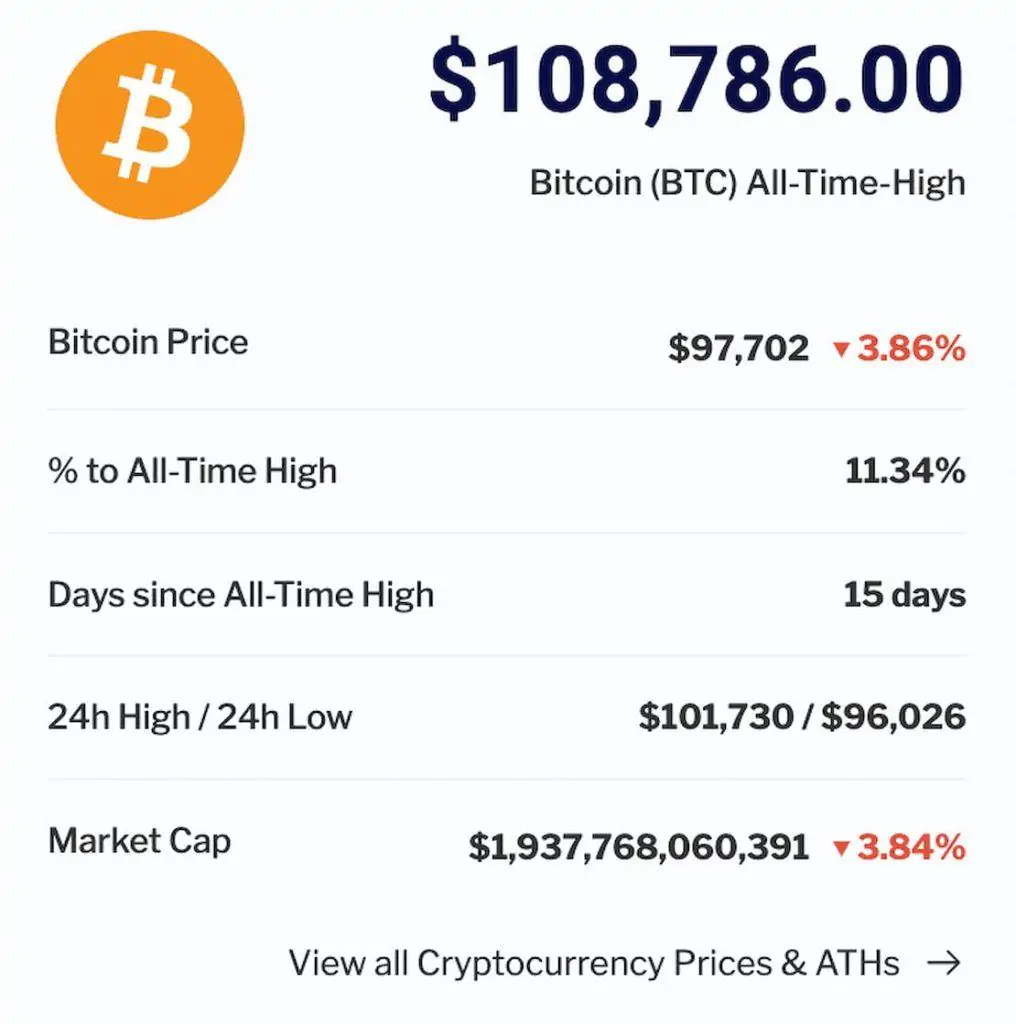

In December 2024, Bitcoin reached its another ATH ($108,786.00).

However, experts are saying that we can expect a number of new picks this year thanks to all the green flags we’ve mentioned.

Recently, one of Blackrock’s managers suggested that a 1%-2% BTC exposure is OK for your portfolio, which might sound really weird given that Blackrock is one of the biggest holders of spot Bitcoin ETFs. It runs the iShares Bitcoin Trust (IBIT). The expert refers to the well known rule that it’s always better to own less if your asset can go down to zero. Thus, losing a significant amount of money is worse than having a moderate passive income.

Saying this, there is some reason in the experts’ thoughts, as BTC has its pros and cons, which you should take into account before making a final decision about investing.

Bitcoin pros

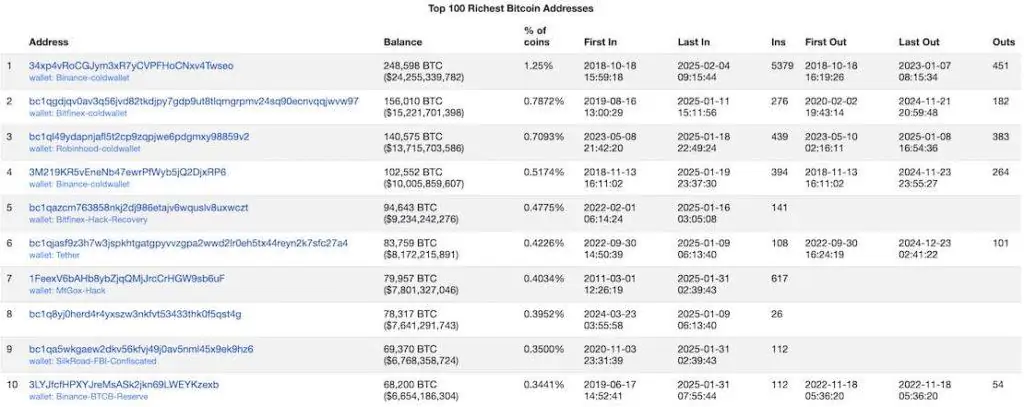

Strong growth potential: Since its inception, digital gold has been profitable for early investors. Some of the biggest BTC investors include well-known companies such as MicroStrategy, Tesla, Grayscale, Binance and Coinbase. If you take a closer look at the top 10 richest BTC addresses, you’ll see that all of them have been holding cryptocurrency for 5-6 years. The first five own billions of dollars in BTC and never withdraw it, even in bad times.

Bitcoin has experienced huge exponential growth and will continue to grow in 2025.

High market liquidity: BTC market cap in January 2025 was more than $1.9 trillion, and its 24-hour trading volume was more than $141.9 billion. There’s a lot of liquidity for the crypto market, more than any other cryptocurrency can offer. And when the market is highly liquid, you can easily buy or sell any cryptocurrency, which means the digital asset will be very popular among crypto users. To date, the cryptocurrency market is full of people willing to buy Bitcoin, so the market capitalization allows you to do it quickly and easily in the most convenient way possible.

Inflation Hedge: Many investors view Bitcoin as an effective hedge against inflation, as its market value has historically outpaced inflation. Now we’re living in times of great economic uncertainty, where the situation can change in a matter of days or hours. Many investors now see digital gold as the best way to store their wealth. BTC has all the important characteristics to be called a perfect hedge asset, or “hard asset” as they call it. Firstly, Bitcoin is good because it is scarce, which means that its limited supply is likely to increase demand and drive up prices. Second, the asset is very accessible, which means that the traditional market will be happy to welcome it. Third, Bitcoin is durable: it has been around for a long time and will continue to attract demand over time.

Better protection: Bitcoin has a lot of exchange-traded products to offer. This has made it easier to invest in it, and retail investors are protected from losses if brokers or crypto custodians collapse. In addition, BTC is protected by cryptography and is based on the most transparent blockchain technology system ever. You can’t change a block on it because you have to change all the previous ones first – that’s how the system works. That’s why Bitcoin is considered one of the most secure blockchains in the world.

Also, while traditional portfolios are often vulnerable to market volatility and inflation, BTC is protected by its limited supply of 21 million coins. That’s why it’s completely resistant to all market fluctuations. Its blockchain doesn’t reveal ownership, giving you complete privacy and anonymity.

Bitcoin cons

Too volatile: Bitcoin’s price has continued to rise since the first block was created in 2009. However, it is also prone to volatility. Daily price changes can be huge, amounting to thousands of dollars per day. For example, in March 2020, during the pandemic, digital gold experienced one of the biggest falls in its history: it lost half its value in two days. Within a month, it fell from over $10,000 in February to under $4,000 in March.

The same price drop happened seven years earlier when China banned BTC in late 2013. The first cryptocurrency lost 50% of its value overnight.

Fees are high: Bitcoin transactions can be quite expensive to process, ranging from $1 to $100 or forever. Some centralized exchanges such as blockchain.com have EUR/USD-BTC fees of up to $40 or $50 depending on the country and other conditions. The largest transaction fee paid in history was a transaction that happened in block 818087. Someone simply paid $3.1 million in transaction fees. But that’s not all: the lucky miner received the standard 6.25 BTC as well as 85.2163 BTC in fees for all transactions included in the block.

Not ESG Friendly: ESG investing – also known as sustainable, socially responsible or impact investing – is an approach that integrates environmental, social and governance factors into investment decisions with the aim of achieving both financial returns and positive social impact. So-called ESG-conscious investors are sometimes sceptical about mining, believing that converting energy into a virtual investment can be harmful to nature. They also believe that only the very wealthy can afford it. And they are partly right, because there are many cases of Bitcoin mining farms being supported by political figures in different countries around the world.

Limited inflation protection: Of course, many investors see Bitcoin as a perfect hedge against inflation. However, as BTC is still a fairly volatile digital asset, there’s still a risk that it could grow faster than inflation in the future. There is a general law: when the value of fiat money goes down, all digital assets with limited supply go up, including stocks, real estate, shares and Bitcoin. However, digital gold is also subject to inflation the more it is mined. That’s why halving plays a crucial role in its ecosystem to reduce inflation rates. Because mining for new BTC is automatically reduced by 50% every four years, the impact of inflation on it remains minimal to moderate.

Pure Bitcoin investment offers no protection: it is fully decentralized, which has its pros and cons. There are no third parties in the system, which means that only you are responsible for your assets, transactions and, more importantly, your keys. So if one of your keys is stolen, it is 100% your responsibility. Some exchanges may have insurance, but you should not rely on this. Make sure you keep your keys and passwords safe (write them down and keep them in a safe place offline).

Is investing $100 in Bitcoin worth it?

Keep in mind that BTC is a fairly volatile asset, so investing $100 is not a guarantee that you’ll see your hundred dollars in Bitcoin in your account in a few hours. However, despite the fact that investing in this crypto asset can be very risky, you can also expect high returns.

If you exchanged $100 for BTC at the beginning of 2019, when the price fell to $3000, you would now have almost $3333. Imagine if the amount was 10 times or more. Bitcoin has gone through many brutal corrections, but it has always come back, and you should take this into account before buying it or, more importantly, withdrawing it from your bank account. FOMO is always there.

When discussing how high Bitcoin can go after another ATH, many experts look at different market scenarios, including bear, base and bull. So different scenarios mean different amounts of money you’ll get:

- Bear case, $258,500: $100 would be worth $289.52 today, up 189.5%.

- Base case, $682,000: $100 would be worth $763.84 today, up 663.8%.

- Bull case, $1,480,000: $100 would be worth $1,657.60 today, up 1,557.6%.

- Bull case, $3,800,000: $100 would be worth $4,256.00 today, up 4,156.0%.

Cathie Wood, CEO of Ark Invest, is convinced that a bullish scenario is absolutely possible if the top 10 major companies (or more) allocate 5% to Bitcoin.

NB! It’s just a theory that has never been observed in practice. We never give advice on how to trade, so it’s up to you how to use the information.

Bitcoin ETFs: are they worth your attention?

Many investors consider ETFs to be a more effective way to invest in Bitcoin. In early 2024, the price spiked back above $40,000 on high hopes for the approval of BTC spot ETFs. After the ETFs were approved in mid-February 2024, the price of the first cryptocurrency climbed to over $50,000.

It is clear that ETFs have become one of the main price levers and another valuable asset for investors to consider.

What are ETFs and why is their approval a positive sign for the market?

A Bitcoin exchange traded fund (ETF) is an investment that provides ordinary investors with exposure to its price movements. Spot ETFs give investors a regulated, legal way to indirectly invest in Bitcoin through their brokerage accounts.

Licensing ETFs lowers the threshold and makes buying BTC more accessible to average investors. It’s like buying shares in any other ETF or security. To date, spot Bitcoin ETFs are available on all major traditional trading platforms (e.g. New York Stock Exchange, Nasdaq), which can be a huge boost for its mass adoption and global recognition, especially in financial circles. Investing in spot ETFs is easier because you don’t have to dive deep into crypto and learn all the rules of the ecosystem.

This makes it a perfect way to invest in BTC for a newbie or someone coming from traditional trading.

Where can I buy spot Bitcoin ETFs?

Spot Bitcoin ETFs are now available on many online brokerage and robo-advisor platforms. However, be sure to check all fees and other conditions on the platform before investing.

High management fees, such as Grayscale’s 1.50%, can significantly reduce your ETF gains. Focus on platforms with annual management fees between 0.2% and 0.5%.

How to invest in spot Bitcoin ETFs

Investing in spot Bitcoin ETFs takes about 30 minutes. All you need to do is open a brokerage account and make your first purchase.

- Make a DYOR and choose a company that offers Spot BTC ETFs. Open your first online brokerage account.

- Fund your account. Make sure you have enough money to cover not only the cost of your spot ETF, but also any platform fees and commissions.

- Search for available BTC ETFs. There are currently 11 Bitcoin ETFs approved by the SEC. The key characteristics to look for are high trading volumes and high crypto assets under management (AUM). Always check the reputation of the issuer.

- Compare several ETFs you’ve selected. Finish your search and compare the pros and cons of several ETFs: many platforms offer the option of comparing fees online. Consider your budget, investment goals and type of investment (long-term or short-term).

- Place an order. Place your buy order for the BTC ETF you’ve chosen. Remember, just like on the stock exchange, you have to choose between a market order and a limit order – a market order allows you to buy the ETF within minutes, while a limit order executes the transaction at the price you set.

- Track your ETFs regularly. Monitor Bitcoin charts daily, track all BTC related news as well as your ETF portfolio.

Spot Bitcoin ETFs is a good investment if you know all the rules.

Bitcoin mining: invest in stocks

Bitcoin miners remain the rock stars of the industry. With another halving taking place, it is becoming increasingly difficult to get rewards. However, mining equipment is still in demand.

In this article, we won’t go into the complex process of installing mining equipment to get rewards. It’s a complex subject that we’ll cover later. What if you don’t want to be involved in the mining process? In this case, consider investing in the companies that mine Bitcoin.

There are many well-known and respected companies associated with BTC mining, including Hut 8 (NASDAQ: HUT), MARA Holdings (NASDAQ: MARA), and Clean Spark (NASDAQ: CLSK), among many others.

Always remember that BTC stocks tend to be as volatile as Bitcoin itself, so always DYOR. Take into account various factors, including hash rate capacity, share price change (volatility) and location (different countries have different mining regulations, so it’s better to choose more legal ones). USA, Singapore, Australia and Canada are the leading countries that represent all the top Bitcoin mining companies nowadays. So you should focus on them first when looking for the best stocks.

However, it is always better to research the subject before investing. Make sure you consult your financial advisor and read up on mining before making your final decision.

What will Bitcoin be worth in 2025?

There are undoubtedly many factors that will influence the price of Bitcoin in 2025. Institutional adoption, ETF progress and regulatory developments are among the key factors shaping the upward trend.

In 2024, firms such as BlackRock, BNY Mellon and Fidelity have already included Bitcoin in their offerings. If the trend continues in 2025 and more companies accept it, the price will definitely remain stable or rise.

If US government support remains at the same level and a Bitcoin Federal Reserve is created, the demand for BTC will be immense. So if all predictions come true, we’ll see another rally. CNBC analyst Tom Lee’s prediction is $250,000. Matthew Sigel (VanEck) predicts $180,000.

The bottom line

Is Bitcoin a good investment? Yes, it is. There are several ways to earn passive income from digital gold in a crypto market, including simple investing, mining and spot ETFs.

However, the most important factor about BTC that can’t be ignored is its historical growth. The first cryptocurrency has never disappointed. So if you believe in its long-term potential, it’s high time to invest.